Medicare Tax Rate 2025 Caps - Medicare Employee Tax Rate 2025 Lani Shanta, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. 2025 Medicare Irmaa Costs Roby Vinnie, The medicare tax rate for 2023 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. May 21st, 2025, 5:09 am pdt.

Medicare Employee Tax Rate 2025 Lani Shanta, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

Medicare Part A Cost 2025 Clara Demetra, Refer to publication 15 (circular e), employer's tax guide for more information. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.

2025 Part D Dona Juliet, Refer to publication 15 (circular e), employer's tax guide for more information. [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax.

The medicare tax rate for 2023 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. 2025 2025 2026 medicare part b irmaa premium magi brackets.

Your Guide to 2025 Medicare Part A and Part B BBI, If you have to pay a premium, you’ll pay as much as $505 per month in 2025, depending on how long you or your spouse worked and paid medicare taxes. 2.9% of your untaxed income for the medicare tax.

The 2025 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023.

2025 Medicare NonFacility Reimbursement Rates for Care Management Services, The total medicare tax rate in 2025 is 2.9%. Stocks brace for nvidia's numbers on wednesday.

2025 Tax Brackets Aarp Medicare Heda Rachel, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. The current rate for medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Medicare Tax Rate 2025 Caps. In 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2023. In 2023, the medicare tax rate is set at 1.45%, which is matched by an additional 1.45% from employers, for a total of 2.9%.

2025 Medicare High Surcharge Glori Kalindi, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. The annual deductible for all medicare part b beneficiaries will be $240 in 2025, an increase of $14 from the annual deductible of $226 in 2023.

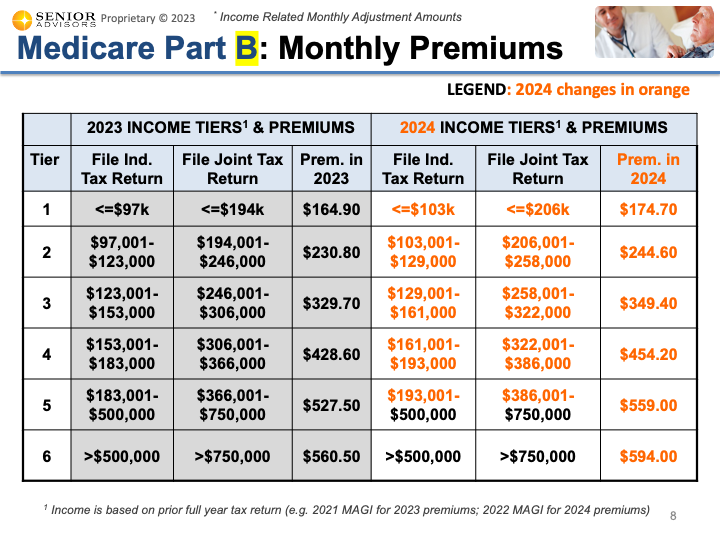

For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60 to $594.00 depending on.